Being a business owner comes with tough decisions — is it time to seek investors, or should you self-fund a little longer? Should you sell? Is it time to revamp your product?

You can’t make the most critical business decisions without knowing whether your business is financially stable. Enter: profit and loss statement.

In this piece, I’ll go over what a profit and loss statement is, how it helps you drive business decisions, and walk you through the step-by-step process of creating your own.

Table of Contents

What is a profit and loss statement?

A profit and loss statement, or P&L, is a financial document showing a business’s monthly, quarterly, or yearly revenue, profit, and losses. It identifies a company’s financial health for internal decision-making, or entices buyers and investors to purchase or fund the business.

What is the purpose of a profit and loss statement?

The purpose of a profit and loss statement is to give you an overall understanding of financial performance, and whether changes need to be made to company strategy to improve performance. A profit and loss statement:

- Gives you an overview of financial performance (based on your bottom line) and whether your company/business is making or losing money.

- Gives you operational insight into different revenue streams and expense categories so you can ensure strategies are optimized to drive revenue.

- Helps drive decision-making for critical functions like resource allocation, pricing, and cost management.

- Gives critical stakeholders (like investors and creditors) the information they need to understand the value of their investments to drive decisions on future actions (like increasing investments)

.png)

Free Financial Planning Templates

Manage your business and personal finances with these five financial planning templates.

- Balance Sheet Template

- Profit & Loss Statement Template

- Financial Projection Template

- And More!

Download Free

All fields are required.

.png)

You're all set!

Click this link to access this resource at any time.

Is an income statement the same as a profit and loss statement?

Income statements. Profit and loss statements. Balance sheets. While these terms are commonly thrown around, they’re not all interchangeable.

“An income statement is known as a P&L statement,” says Francis Fabrizi, an accountant at Keirstone Limited. “There’s no difference between the two, whereas a balance sheet provides a quick overview of the company’s [entire] financial information. This is usually a broader view showing assets, liabilities, and income. However, an income statement is more useful in showing specific cash flow details.”

Profit and Loss Statement Template

Now we know what a profit and loss statement is (and what it isn’t), but how do you actually create one?

I’m about to walk you through that below, but first, I recommend downloading our so you can fill in your numbers as you follow along. I’ll be using the template during the walkthrough to give you a feel for the process.

How to Do a Profit and Loss Statement (Step-by-Step Walkthrough)

You can complete a profit and loss statement with an accounting tool (like QuickBooks), manually with software like Excel, or get a jump-start with a prebuilt template (like ours I mentioned above).

Fabrizi tells me that a benefit to cloud-based accounting software is that it allows you to quickly create P&L statements: “Most of the calculations are automated from receipts and invoices, so it’s less likely for anything to be overlooked or miscalculated.”

Software tools often offer various statement formats (like bar charts or line graphs) that help you visualize trends and make business decisions.

Regardless of how you create it, there are six key areas to include in a P&L statement:

- Revenue: net money received from sales

- Cost of goods sold (COGs): total cost of making or buying the products sold

- Gross profit (or loss): earnings after subtracting COGS

- Operating expenses: amount spent to maintain daily operations

- Operating profit (or loss): income from core operations

- Net profit (or loss): total income minus expenses (COGs, debt, interest, etc.)

1. Revenue

The revenue section of a profit and loss statement includes all the income your business receives from day-to-day operations.

“This covers the sale of goods and services, and other sources of income, such as the disposal of used office supplies,” says Fabrizi.

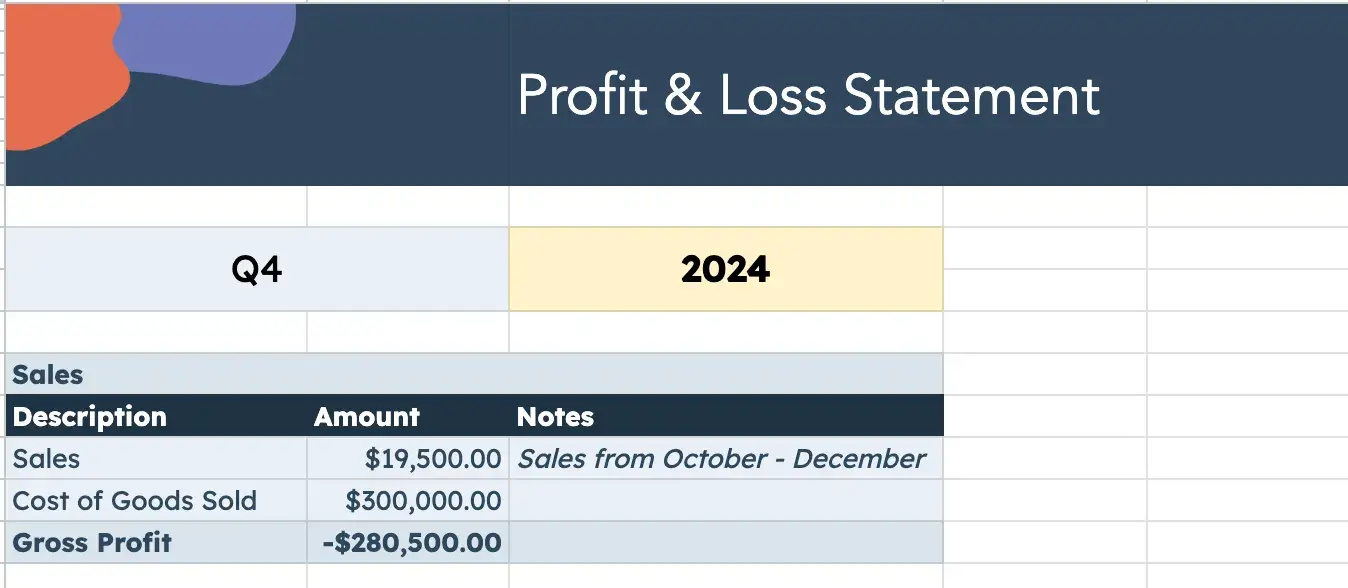

Before calculating your total income, determine the time frame you’re calculating for. If it’s quarterly, you’d add all the sales generated during those three months to get accurate revenue figures.

For example, if you reeled in:

- $5.7k in October

- $10.3k in November

- $3.5k in December,

Your total net sales is $19.5k. Here’s what my P&L Statement looks like with those numbers:

2. Cost of Goods Sold (COGS)

The cost of goods sold is the amount you spend on materials to operate your business. For example, purchasing inventory to manufacture or sell products, or machinery to perform a service for customers.

“If you own a cafe and charge $2.50 for a coffee to go, your profit isn’t $2.50. Costs like the price of the coffee beans and the takeout cup must be subtracted. Another illustration: You need to account for supplier costs; if you sell an item, you don’t make it yourself,” Fabrizi explains.

Indirect costs (e.g. rent, accounting, and marketing) that are not expressly associated with the creation of services and goods are not part of COGS, notes Fabrizi. These fall under additional expenses or operating costs.

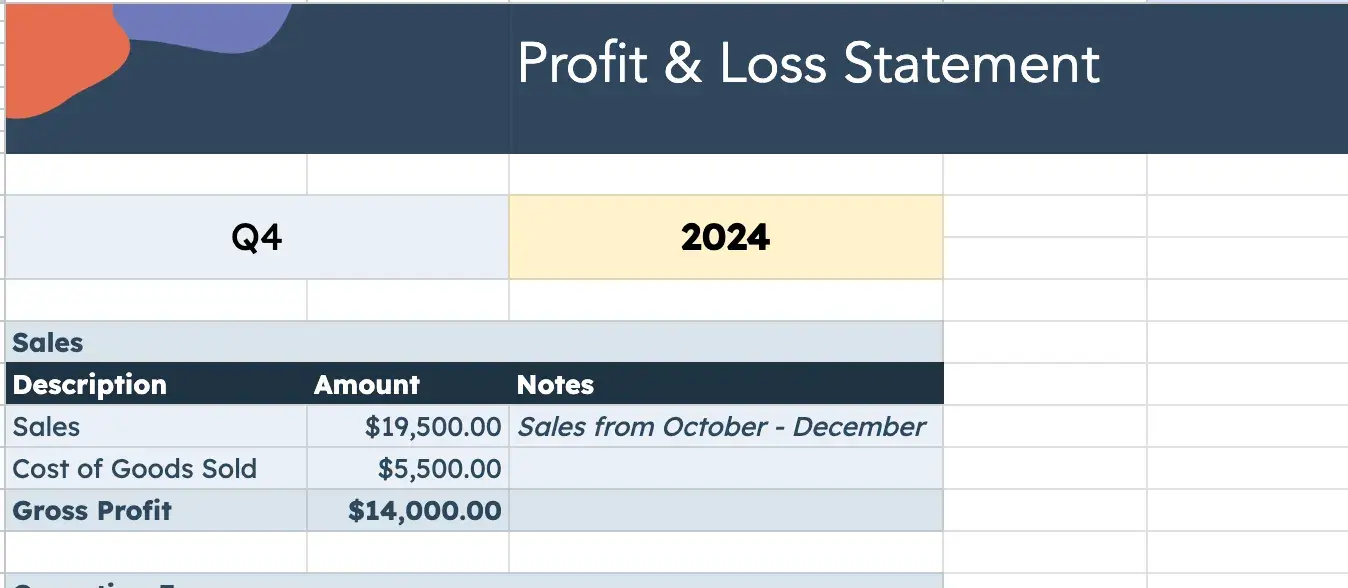

For this example, I’ll add a COGS of $5.5K to my P&L statement.

3. Gross Profit (or loss)

Gross profit is how much you earn after subtracting COGs. Our template automatically calculates gross profits, so I can already see that my gross profit for Q4’24 is $14K.

If you do this manually, calculate your gross profit by subtracting your COGS from your net sales/revenue: (revenue - COGS) = gross profit.

With my example, 19,500 - 5,500 = 14,000.

4. Operating Costs (Expenses)

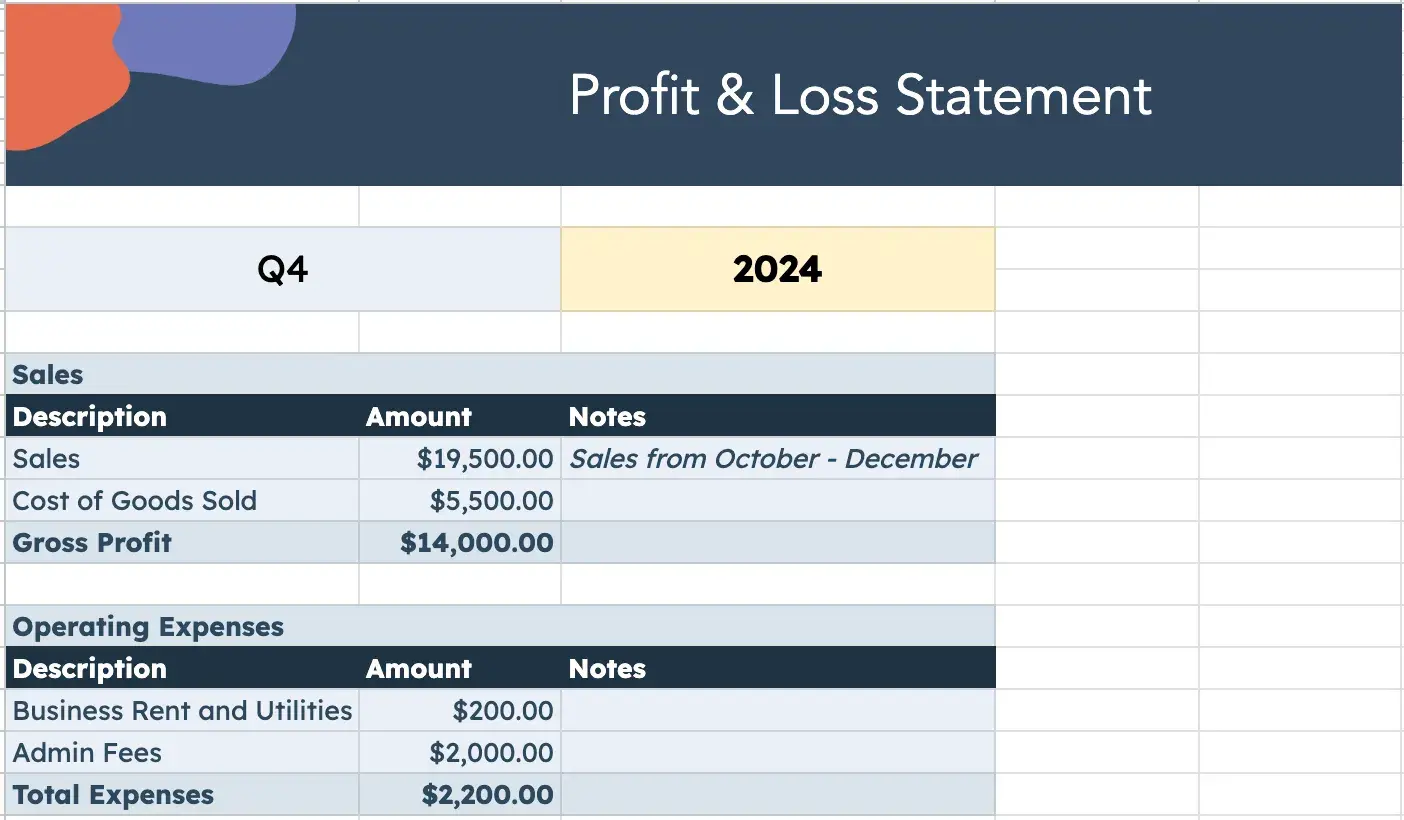

Under the operating expenses bucket, you calculate how much you spend to maintain daily business operations. This includes:

- Employee salaries

- Business rent and utilities (business phone, office space, etc.)

- Depreciation of company equipment (computers, office furniture, vehicles, etc.)

- Administrative fees (insurance, office supplies, and other items not directly connected to specific goods or functions)

For my example, let's say that my operating costs include business rent, utilities, and administrative fees, totaling $2.2K. Here’s how I note that in my P&L:

Note: This is a simplified example. You’ll likely have more expenses and expense categories. To add more expense rows to our template, right-click and select “+ Insert 1 row.”

5. Operating Profit (or loss)

Operating profit is the total your business gets after deducting COGS and additional expenses. To calculate this, you subtract your operating expenses (called “Total Expenses” in our P&L template) from your gross profit. The formula:

(Revenue - COGS) - Operating Expenses = Operating Profit

So, for my example:

(19,500 - 5,500) = 14,000 (gross profit)

14,000 - 2,200 (total expenses) = 11,800 (operating profit)

At this point, you can also add your COGS and operating expenses to total your expenses. My total expenses are $7.7K (5,500 + 2,200).

6. Net Profit (or loss)

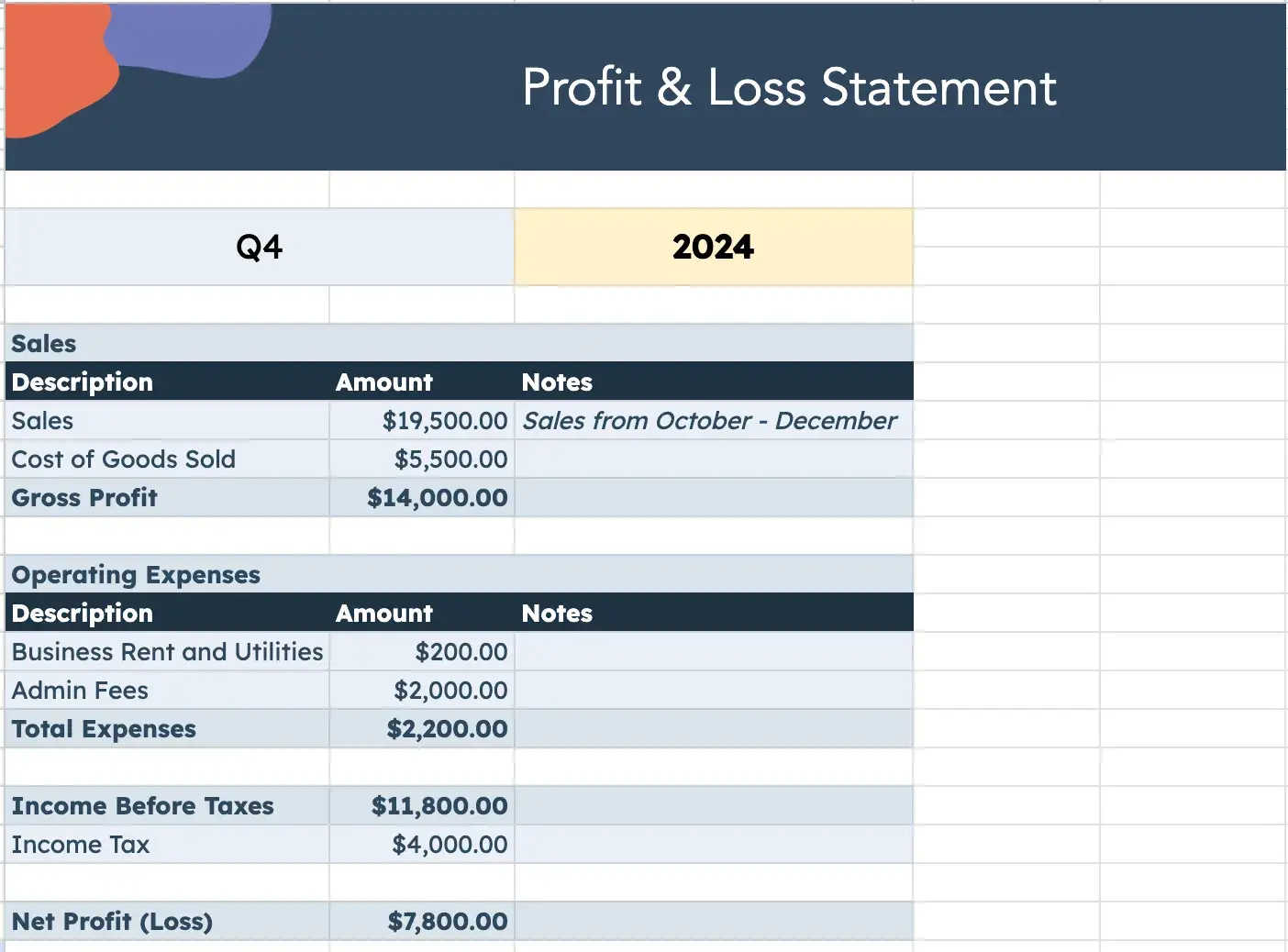

Net profit is your total revenue minus all costs (COGS, operating expenses, debt interest, and taxes). In other words, it signifies what eventually ends up in your company’s coffers.

For this example, I’ll add a total tax of $4K to my template. The calculation is automatic, so I already see that my net profit for Q4’24 is $7.8K:

If you’re doing this manually, the formula is:

Operating Profit - (Debt Interest + Taxes) = Net Profit

So, if my debt interest and taxes are $4k, my formula is:

11,800 - 4,000 = 7,800 (Net Profit)

If your net profit is negative, you’d have a net loss instead of a net profit.

.png)

Free Financial Planning Templates

Manage your business and personal finances with these five financial planning templates.

- Balance Sheet Template

- Profit & Loss Statement Template

- Financial Projection Template

- And More!

Download Free

All fields are required.

.png)

You're all set!

Click this link to access this resource at any time.

How to Read a Profit and Loss Statement

The purpose of reading a P&L statement is to determine the profitability of a business. You’ll have to review the P&L statement line by line to identify if the company is running at a loss (and won’t owe any taxes) or netting a profit.

Before you start, determine the period of the statement (month, quarter, year) to get a clearer picture of the company’s finances.

Next, determine if the accounting method is:

- Cash basis: Income and expenses are reported immediately when they occur

- Accrual basis: Income and expenses are reported even if money hasn’t exchanged hands yet

This matters because accruals may not occur until months later, affecting the actual income or expenses in a given time period. For example, earning $55k for the quarter (cash basis) and having $15k in unpaid invoices for projects already completed.

When you add it together, you get an income of $70k. But if you don’t receive the $15k until three months later, you may miscalculate what you can spend on expenses for the quarter, landing you in a deficit.

Profit and Loss Statement Example

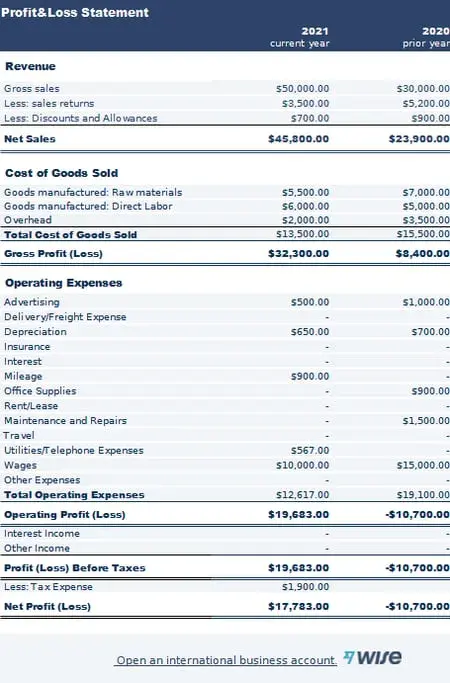

Here’s an example of a P&L statement.

I see a net loss of $10.7k in 2020. Then, in 2021, business operations improved, earning a net positive profit of $17,783.

If you’re creating your profit and loss statement manually, I recommend checking your math and calculations line by line. Accidental human error can prevent accurate profit margin analysis.

As you review, note areas where you can cut costs to increase profits. For instance, performing more maintenance on equipment to prevent costly breakdowns. Or switching to a cheaper insurance provider or office space.

Audited vs. Unaudited Profit and Loss Statement

Having your P&L statement audited by a licensed CPA ensures accuracy, and if you’re anything like me, I’d want to make sure my math is accurate. Plus, investors and banks often request an audited P&L before agreeing to invest in or fund your business.

“One of the biggest mistakes business owners make when preparing their own P&L statements is not putting the correct type of revenue and expenses on the statement,” says Amine Alajian, CPA and founder of the Alajian Group, an accounting firm for startups.

“Assuming that all money that comes in is revenue and all money that comes out is an expense is incorrect. For example, if you get money for a loan, that’s a liability, not revenue. Along those same lines, when you pay that loan back, that’s not an expense and should not go on the P&L."

Don’t think of a P&L audit as a bad thing — it’s not like having the IRS come to review your financial statements. It provides an extra pair of experienced eyes to review your finances to prevent reporting mistakes and instill confidence in stakeholders and investors. I strongly recommend doing this, regardless of how confident you are in your financial calculations.

Over to You

It’s important for business owners, especially those hoping to grow, to keep a close eye on profits and losses.

Financial reporting is essential for business owners, especially those hoping to grow.

Creating a profit and loss statement helps you monitor critical figures, make strategic business decisions, and communicate important information to stakeholders. If you decide to sell or seek investments, you’ll also have the proof to negotiate the best deal.

Editor's note: This post was originally published in August 2022 and has been updated for comprehensiveness.

.png)

Free Financial Planning Templates

Manage your business and personal finances with these five financial planning templates.

- Balance Sheet Template

- Profit & Loss Statement Template

- Financial Projection Template

- And More!

Download Free

All fields are required.

.png)

You're all set!

Click this link to access this resource at any time.

.png?width=112&height=112&name=ebook%20cover%20-%20%20transparent%20-%20financial%20planning%20templates%20(1).png)